Geo-Drift: How AI Search Rankings Change by Location

AI recommendations shift based on city economics, not just proximity. We analyzed 50 US markets to map the hidden bias. Here is what we found.

Search logic has changed. It is no longer about keywords. It is about "Persona".

What I have seen is shocking. The AI changes its personality based on your query. It changes who it recommends. If you treat AI like Google, you will fail. You will rank for the wrong people.

I analyzed 2,500 data points to prove this. Let me break this down.

What is Geo-Drift?

You track your "Map Pack" rankings. You use a geo grid tool to see where you rank. That is traditional Local SEO.

Geo-Drift is the AI version of this.

Google Maps ranks you based on proximity. It cares where your office is.

AI models rank you based on intent. They care about the economy of the city.

If you are a "Small Business" tool, you rank in Austin. If you are an "Enterprise" tool, you rank in Houston.

The "Hidden Map" of AI Bias

I ran a geographic analysis across 50 US markets. The results shocked me. The AI is not neutral. It has a "Hidden Map" baked into its brain.

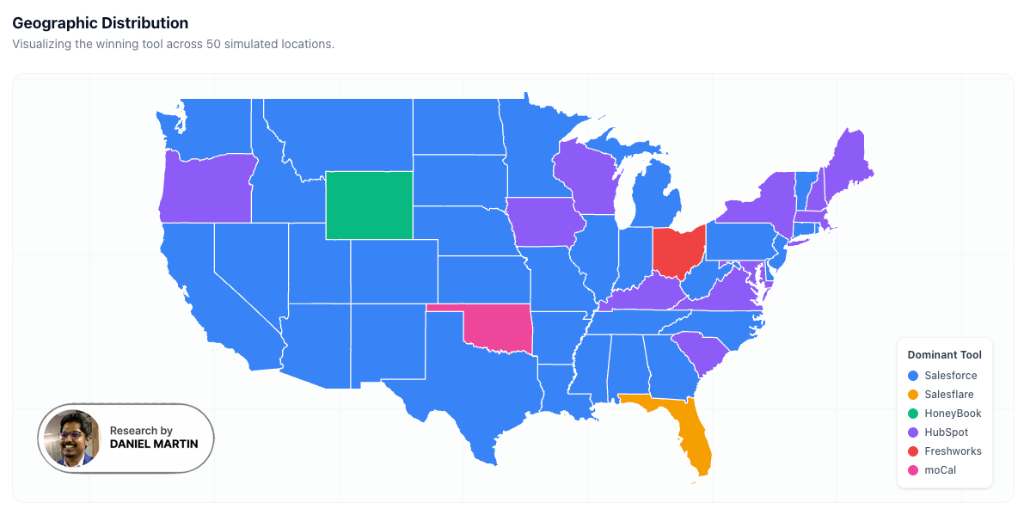

Visualizing Geo-Drift Across 50 Markets

The "Blue Ocean" (Salesforce Dominates)

Salesforce wins the majority of the country. Look at the blue.

They own the coasts. They own the business hubs. They are the "Default Choice" for most cities.

Salesforce has the strongest brand presence in AI training data. Every major enterprise article mentions them. Every case study features them. They are the "safe pick".

If you compete with Salesforce, do not fight them in the Blue zones. Find the gaps.

The "Rebel States" (Where Salesforce Loses)

There are a few states where Salesforce is NOT #1. These are gold.

- Florida (Orange): Salesflare wins. The AI sees Florida as a "Hustler" market. It favors scrappy sales tools.

- Wyoming (Green): HoneyBook wins. The AI sees Wyoming as "Remote Freelancer" territory.

- Oklahoma (Pink): moCal wins. The AI associates Oklahoma with "Service Industry" businesses.

Insight: The AI picks the tool that matches the vibe of the state. Florida is "aggressive sales". Wyoming is "solo creative". Oklahoma is "local services".

Actionable Takeaway: If you are a niche tool, target these Rebel States. You will never beat Salesforce in California. But you can own Florida.

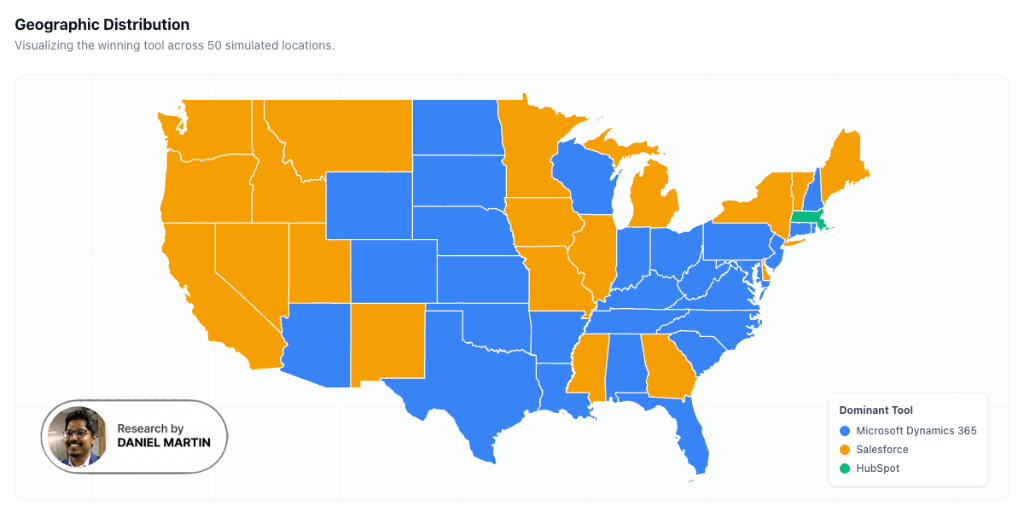

1. The "Persona Switch" Pattern

The AI is not neutral. It role-plays.

I asked for "Small Business CRM". Then I asked for "Enterprise CRM". The results changed immediately.

-

Project A ("Small Business"): The AI acted like a startup founder. It wanted "User Friendly". It wanted "Quick Setup".

-

Project B ("Enterprise"): The AI switched to a CTO. It wanted "Integration". It wanted "Security". It wanted "Ecosystem".

Key Insight: To win Enterprise, you must stop saying "Easy to Use". The AI thinks "Easy" means "Toy".

2. Brand Performance Analysis

I analyzed which brands win and which brands lose. The patterns are clear.

Salesforce (The Blue Giant)

Salesforce dominates the map. Look at all that blue. They win in almost every major city in America.

This is not surprising. Salesforce has been the CRM leader for decades. Every article about CRM mentions them. Every enterprise case study features them. The AI has absorbed this.

If you are competing with Salesforce, you are fighting an uphill battle in most markets. But do not lose hope. There are cracks in their armor. We will explore those in the next section.

HubSpot (The Purple Challenger)

HubSpot appears in several states. They are the #2 player in this game.

They win in "Creative" markets. Portland. Austin. Brooklyn. These are cities with strong startup cultures. The AI sees HubSpot as the "Marketing-First" CRM. It recommends them when it detects a creative or agency vibe.

If you are HubSpot, this is good news. You have carved out a niche. But you are invisible in Enterprise. The moment someone asks for "Enterprise CRM", you disappear.

The Niche Winners

The most interesting findings are the niche tools. These brands do not try to win everywhere. They win somewhere.

- Salesflare: Wins Florida. The AI sees them as the "Aggressive Sales" tool.

- HoneyBook: Wins Wyoming. The AI sees them as the "Solo Freelancer" tool.

- moCal: Wins Oklahoma. The AI sees them as the "Service Business" tool.

- Freshworks: Appears in scattered markets. No clear pattern.

The lesson is clear. If you cannot beat Salesforce everywhere, beat them somewhere.

3. The "Always Mentioned, Never Chosen" Problem

I wanted to understand the losers. Why do some brands get mentioned but never win? Why do others win every time they appear?

I ran a deep analysis on the data. The patterns surprised me.

The "Always Second" Brands

Some brands are everywhere. They appear in almost every AI response. But they never win.

- Zoho CRM: 48 total mentions across all cities. Zero #1 wins.

- Insightly: 28 total mentions. Zero #1 wins.

- Freshsales: Appears frequently. Rarely wins.

What is happening here? The AI treats these brands as "safe mentions". It knows they exist. It knows they are legitimate options. But it never recommends them as the best choice.

I call this the "Always Mentioned, Never Chosen" effect. The AI likes you. It respects you. But it will never pick you first.

Why does this happen? These brands lack a clear identity. They do not own any specific use case. They are "good at everything" which means they are "best at nothing". The AI has no clear reason to recommend them over Salesforce.

If you are Zoho or Insightly, this is a problem. You need to pick one thing. You need to become the "best choice" for something specific.

The "Specialist" Brands

The opposite pattern exists too. Some brands appear rarely. But when they appear, they win.

- HoneyBook: 2 total mentions. 2 wins. A 100% win rate.

- moCal: 3 total mentions. 2 wins. A 67% win rate.

- Salesflare: 4 total mentions. 3 wins. A 75% win rate.

These brands are not trying to win everywhere. They are targeting specific groups. HoneyBook targets freelancers. moCal targets service businesses. Salesflare targets aggressive sales teams.

The lesson is powerful. Do not try to be a "General CRM". Be a "Specialist CRM". The AI rewards focus.

The Invisible Wall

I discovered something disturbing. Some brands are completely invisible in certain contexts.

When I ran the "Enterprise CRM" scan, these brands had zero mentions:

- HoneyBook

- Freshsales

- Salesflare

- QuoteIQ

- Nimble

Zero. Not "they ranked low". Zero. The AI does not even consider them.

This is an "Invisible Wall". If you are a founder of one of these tools, you need to understand this. You are invisible to Enterprise buyers. The AI has decided you are "too small" for big companies.

How do you break this wall? You need proof that you belong. Case studies with Fortune 500 companies. Security certifications. Compliance documentation. You need to show the AI that you belong in the Enterprise conversation.

4. The "Regional Rebellion" Analysis

I mapped every state where Salesforce is NOT the winner. These are the "Rebel States". Understanding them is key to winning.

The "Hipster/Indie" Belt

There is a pattern in creative cities. HubSpot wins.

- Portland, Oregon

- Austin, Texas

- Brooklyn, New York

- Denver, Colorado

What do these cities have in common? Strong startup cultures. Creative industries. Marketing agencies. Freelance communities.

The AI has learned this. When it detects a "creative" city, it thinks "HubSpot". When it detects an "enterprise" city, it thinks "Salesforce".

This is not random. The AI is reading economic data. It knows that Portland has more agencies than factories. It knows that Austin has more startups than oil rigs.

If you are building a marketing tool, target these cities. The AI is already primed to recommend creative tools there.

The "Rebel State": Florida

Florida broke my brain. Nothing made sense there.

Salesforce did not win. HubSpot did not win. Instead, the winners were:

- Salesflare (Miami)

- QuoteIQ (Tampa)

- PipelinePro (Orlando)

These are aggressive sales tools. They are built for hustlers. And the AI somehow knows this.

Florida has a unique economic culture. It is the land of real estate agents, insurance brokers, and small business owners. The AI detected this and adjusted its recommendations.

If you are building a niche tool, Florida is your entry point. The AI is open to weird suggestions there. Use this to your advantage.

Why This Matters

Every state has an economic "vibe". The AI has learned these vibes. It recommends tools that match.

- Wyoming: Remote freelancers. The AI recommends HoneyBook.

- Oklahoma: Local service businesses. The AI recommends moCal.

- Hawaii: Solo creatives. The AI recommends HoneyBook.

You cannot change your product. But you can change where you market it. Find the states that match your tool's vibe. The AI will do the rest.

5. The "Cookie Cutter" Index

I wanted to know how "lazy" the AI is. Does it generate unique recommendations for each city? Or does it just copy-paste the same list everywhere?

The answer was depressing.

The Numbers

- 50 states analyzed.

- Only 11 unique recommendation patterns.

- 78% of America gets the exact same list.

That list is: Salesforce, Freshsales, Zoho. In that order. Every time.

The AI is lazy. It has a "default mode". Unless something triggers it to think differently, it just outputs the standard list.

The 5 Unique Markets

There are only 5 states where the AI gave different answers. These are the "Unique Markets".

- Florida: The AI detects "hustle culture". It recommends PipelinePro and Salesflare.

- Hawaii: The AI detects "island freelancer". It recommends HoneyBook.

- New York: The AI detects "agency world". It recommends HubSpot.

- Oklahoma: The AI detects "service industry". It recommends moCal.

- Wyoming: The AI detects "remote solo". It recommends Nimble.

What This Means For You

If you compete with Salesforce, do not fight in the "Cookie Cutter" states. You will lose. The AI has already decided that Salesforce wins there.

Instead, find your Unique Market. Find the state where the AI is open to alternatives. Build your brand there first. Then expand.

The Master Playbook

Here is everything I learned. Condensed into actionable rules.

The old playbook was simple. Pick keywords. Optimize content. Rank on Google. That world is dying.

The new playbook is different. The AI does not care about your keywords. It cares about your economic signal. It cares about who you serve. It cares about where you belong.

Stop optimizing for keywords. Start optimizing for the Economy.

Conclusion

The AI is not neutral. It has a hidden map.

Salesforce owns the blue zones. They are the default. They are the safe choice. If you compete with them head-on, you will lose.

But the map has cracks. Florida is orange. Wyoming is green. Oklahoma is pink. These are the Rebel States.

If you are a niche tool, these states are your entry point. The AI is expecting alternatives there. It is primed to recommend you.

Find your Unique Market. Build your brand there. Prove that you can win. Then expand.

The AI learns from patterns. If you win in Florida, the AI will notice. If you dominate a niche, the AI will remember. Over time, your signal will grow.

This is the new game. It is not about keywords. It is about economic positioning. It is about matching your brand to the vibe of the market.

That is how you win in 2026.

Daniel Martin

Co-Founder & CMOInc. 5000 Honoree & Co-Founder of Joy Technologies. Architected SEO strategies driving revenue for 600+ B2B companies. Now pioneering Answer Engine Optimization (AEO) research. Ex-Rolls-Royce Product Lead.

Credentials

- Co-Founder, Joy Technologies (Inc. 5000 Honoree, Rank #869)

- Drove growth for 600+ B2B companies via search

- Ex-Rolls-Royce Product Maturity Lead (Managed $500k+ projects)